Stock Market Turmoil as Tariff Announcement Sparks Investor Panic

On Tuesday, March 4, the Dow Jones Industrial Average plummeted by 800 points, marking one of the sharpest single-day declines in recent history. The dramatic selloff followed former President Donald Trump’s confirmation of new tariffs on imports from Mexico and Canada, escalating trade tensions and shaking investor confidence.

Market Overview: Dow, S&P 500, and Nasdaq in Freefall

The S&P 500 fell by 3.1%, while the Nasdaq Composite plunged 3.7%, reflecting broad-based weakness across various sectors. Investors fled riskier assets, shifting towards U.S. Treasuries and gold, as fears of an escalating trade war dominated sentiment.

Key Market Movements

- Dow Jones Industrial Average: Dropped 800 points (-2.8%) to settle at 32,450.

- S&P 500: Declined by 3.1%, closing at 4,045.

- Nasdaq Composite: Lost 3.7%, finishing at 12,670.

- 10-Year Treasury Yield: Fell to 3.82%, indicating increased demand for safe-haven assets.

- Gold Prices: Rose 2.1% to $2,150 per ounce, benefiting from market uncertainty.

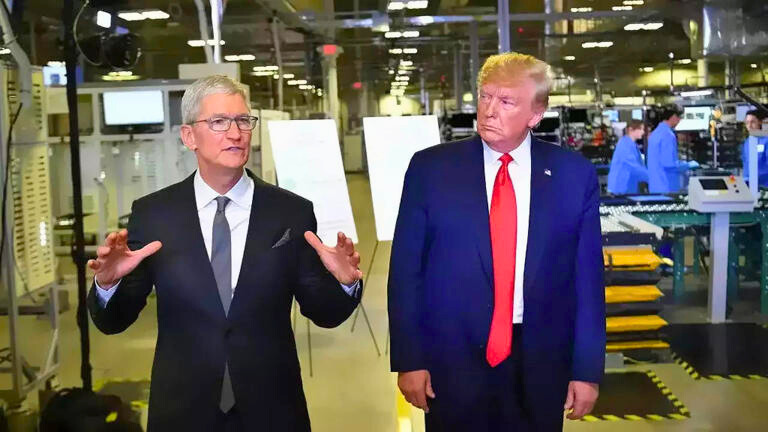

Trade War Fears Amplified by Trump’s Tariff Policy

Trump’s decision to impose 25% tariffs on steel and aluminum imports from Mexico and Canada has rekindled fears of a global trade war. The move is seen as a significant setback to the United States-Mexico-Canada Agreement (USMCA), which was designed to foster free trade among the three nations.

Industries Most Affected

Several sectors took a direct hit due to the announcement:

- Automobile Industry: Companies like General Motors (GM) and Ford (F) fell 5% and 4.2%, respectively, due to concerns over higher raw material costs.

- Technology Sector: Major tech firms, including Apple (AAPL) and Nvidia (NVDA), dropped 4.5% and 6.3%, as fears of supply chain disruptions mounted.

- Manufacturing and Construction: Shares of Caterpillar (CAT) declined 5.1%, reflecting worries over rising costs.

Investor Sentiment: Panic Selling and Flight to Safety

Market analysts pointed to algorithmic trading and institutional sell-offs as major contributors to the sharp decline. Hedge funds and mutual funds moved capital towards U.S. bonds, leading to a drop in Treasury yields.

Investor Reactions

- Retail Investors: Many small investors liquidated holdings, fearing further losses.

- Institutional Investors: Large-scale funds rotated portfolios towards defensive stocks and gold.

- Federal Reserve Expectations: The selloff increased speculation that the Fed might intervene with a rate cut to stabilize markets.

Economic and Political Implications

Impact on U.S. Economy

The sudden decline in the stock market has raised concerns about economic growth and corporate earnings. If trade tensions persist, economists fear a slowdown in GDP growth and potential job losses in affected industries.

Political Ramifications

The tariff decision has also sparked criticism from political leaders and business executives. Many analysts believe this move might impact the 2024 presidential race, as businesses and voters react to economic uncertainty.

What’s Next for the Markets?

Potential Recovery Strategies

- Federal Reserve Intervention: If the market downturn continues, the Fed may signal a rate cut or quantitative easing measures.

- Trade Negotiations: Diplomatic efforts to ease trade tensions between the U.S., Mexico, and Canada could provide relief.

- Earnings Reports: Upcoming corporate earnings will be crucial in determining market sentiment over the next quarter.

Investor Strategies Moving Forward

- Diversification: Investors should consider balancing portfolios with defensive stocks like utilities and consumer staples.

- Gold and Bonds: Safe-haven assets may continue to provide stability amid uncertainty.

- Long-Term Perspective: While short-term volatility is expected, long-term investors should stay focused on fundamentals.

Final Thoughts

The 800-point drop in the Dow Jones underscores the fragility of global markets in response to trade tensions. While short-term pain is evident, strategic investing and policy adjustments could help stabilize the market. Investors should keep a close eye on future trade negotiations and Federal Reserve actions to navigate the turbulence ahead.

Leave a Reply