Introduction

Overtime pay is a crucial aspect of employee compensation, ensuring that workers are fairly rewarded for extra hours worked. However, taxation on overtime earnings has long been a contentious issue, often reducing the additional income employees receive. The recent introduction of no tax on overtime policies in various regions is seen as a breakthrough that benefits both workers and employers. This article delves into the significance of tax-free overtime, its impact on different sectors, and what it means for the economy as a whole.

Understanding Overtime Pay

Overtime pay refers to the additional compensation employees receive for working beyond their standard hours. In most cases, it is calculated at a higher rate, typically 1.5 times the regular hourly wage, and in some cases, even double. The taxation of this extra income has been a matter of debate, as it reduces the financial incentive for workers to put in extra hours.

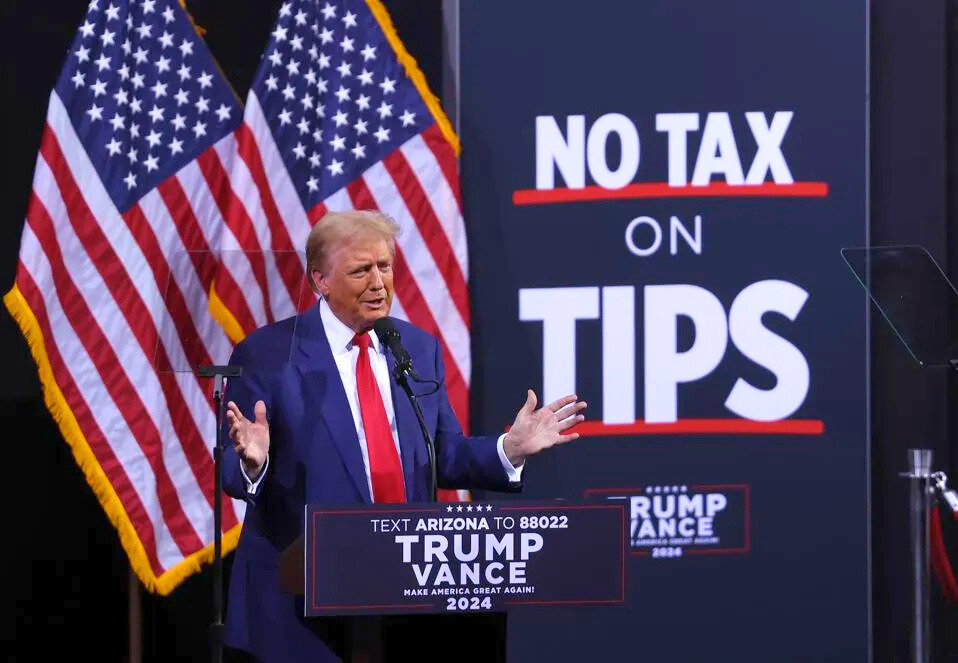

The Concept of No Tax on Overtime

The idea behind a no tax on overtime policy is simple: workers should be able to keep more of their hard-earned money. Governments implementing this measure aim to boost productivity, increase workforce participation, and provide financial relief to employees. By eliminating taxes on overtime wages, employees take home more money, which in turn stimulates consumer spending and economic growth.

Key Benefits of No Tax on Overtime

1. Higher Take-Home Pay for Employees

One of the most obvious advantages of tax-free overtime is that workers get to retain a larger portion of their wages. For employees struggling with rising costs of living, this can be a significant financial relief.

2. Increased Productivity and Workforce Motivation

With more financial incentives to work extra hours, employees are more likely to take on overtime shifts. This can lead to higher productivity levels in various industries, particularly in sectors requiring extended working hours, such as healthcare, manufacturing, and logistics.

3. Boost to the Economy

When workers have more disposable income, they are likely to spend more, which stimulates the economy. Higher consumer spending benefits businesses, leading to greater revenue generation and potentially creating more job opportunities.

4. Reduced Employee Burnout

Some workers avoid overtime because they feel it is not worth the additional tax burden. When overtime earnings are tax-free, employees may feel more motivated and valued, leading to better mental health and reduced burnout.

5. Encourages Employers to Offer More Overtime

For businesses, tax-free overtime can be an incentive to offer more overtime hours instead of hiring additional staff. This can be particularly beneficial for industries experiencing labor shortages.

Challenges and Considerations

While the no tax on overtime initiative has multiple advantages, it also presents some challenges that need to be addressed:

1. Potential Government Revenue Loss

Taxation on overtime contributes to national tax revenues. Removing these taxes could lead to a shortfall in government funds, impacting public services such as healthcare, education, and infrastructure.

2. Possible Exploitation by Employers

If not properly regulated, some companies might over-rely on overtime labor rather than hiring new employees. This could lead to overworked employees and a decline in job creation.

3. Implementation and Compliance Issues

Governments need to establish clear guidelines on who qualifies for tax-free overtime and how businesses should report it. Proper monitoring mechanisms must be in place to prevent misuse.

Countries and Industries Adopting No Tax on Overtime

Several countries have introduced tax-free overtime policies to address economic and labor concerns. These policies vary in scope and application, depending on the industry and economic structure of the country.

1. The Philippines

In response to inflation and rising living costs, the Philippine government has introduced measures to exempt overtime pay from taxes, particularly for low- and middle-income workers.

2. France

France has experimented with tax-free overtime to combat unemployment and encourage productivity. This initiative aims to help workers increase their earnings without additional tax burdens.

3. Japan

With a demanding work culture, Japan has considered tax-free overtime policies to address work-life balance issues and boost employee morale.

How No Tax on Overtime Affects Different Sectors

Healthcare Industry

In the medical field, where long shifts are common, no tax on overtime can encourage more nurses, doctors, and medical staff to work extended hours without worrying about tax deductions.

Manufacturing Sector

Factories and production units can benefit as workers may be more willing to take additional shifts, leading to increased output and efficiency.

Retail and Hospitality

Businesses that experience seasonal demand, such as retail stores and restaurants, can leverage tax-free overtime to efficiently manage peak periods without hiring temporary workers.

IT and Corporate Sectors

For professionals working in project-based roles, tax-free overtime can serve as an additional incentive to complete projects ahead of deadlines.

Future Prospects of No Tax on Overtime

As discussions around no tax on overtime continue to gain momentum, several governments are considering adopting or expanding such policies. However, for successful implementation, policymakers must balance the interests of workers, employers, and government revenue needs.

Recommendations for Policymakers:

- Implement income caps to ensure tax-free overtime benefits low- and middle-income workers the most.

- Establish clear labor laws to prevent companies from exploiting employees.

- Conduct regular evaluations to assess the economic impact of tax-free overtime policies.

- Encourage businesses to maintain fair wages so that employees do not rely solely on overtime for financial stability.

Conclusion

The concept of no tax on overtime presents a promising opportunity to enhance employee earnings, drive economic growth, and increase workplace productivity. While challenges exist, the potential benefits outweigh the concerns if the policy is implemented with proper regulations. Workers, businesses, and governments must collaborate to ensure that tax-free overtime serves its intended purpose—improving the financial well-being of employees while boosting economic productivity.

Leave a Reply